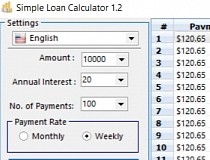

If you have an existing loan input remaining principal, interest rate and monthly payment to calculate the number of payments remaining on your loan. Input different payment amounts for a loan to see how long it will take you to pay off the loan. Input loan amount, number of months required to pay off the loan and payment amount to calculate the interest rate on the loan. If you have an existing loan, input your interest rate, monthly payment amount and how many payments are left to calculate the principal that remains on your loan. Try different loan amounts to see how it affects the required monthly payment. Loan payment table to easily compare principal and interest amounts. Try different loan scenarios and create and print an amortization schedule or create a Find your ideal payment amount by changing loan amount, interest rate, and number of payments in the loan. Calculator OptionsĬalculate the payment required for your loan amount and term. Payment Amount The amount to be paid on the loan at each payment due date. Number of Payments ÷ Payment Frequency = Loan Term in Years. Payment Frequency How often payments are made each year. Number of Payments The number of payments required to repay the loan. The loan payment calculator is aimed at helping you find out the required periodic loan payments after taking a loan with equal payment construction. If compounding and payment frequencies are different, this calculator converts interest to anĮquivalent rate and calculations are performed in terms of payment frequency. Compounding The frequency or number of times per year that interest is compounded. Interest Rate The annual nominal interest rate, or stated rate of the loan. Loan Amount The original principal on a new loan or principal remaining on an existing loan. You can also use ourīasic loan calculator which assumes your loan has the typical monthly payment frequency and monthly interest compounding. Create and print a loan amortization schedule to see how your loan payment pays down principal and bank interest over the life of the loan.Ī key feature of this calculator is that it allows you to calculate loans with different compounding and payment frequencies. Use this calculator to try different loan scenarios for affordability by varying loan amount, interest rate, and payment frequency. So you can think of a loan as an annuity you pay to a lending institution.Calculate loan payments, loan amount, interest rate or number of payments.

Simple loan calc plus#

When you take out a loan, you must pay back the loan plus interest by making regular payments to the bank. For additional compounding options use our

Compounding This calculator assumes interest compounding occurs monthly as with payments. Monthly Payment The amount to be paid toward the loan at each monthly payment due date. Number of Months The number of payments required to repay the loan.

You can also create and print a loan amortization schedule to see how your monthly payment will pay-off the loan principal plus interest over the course of the loan. Find your ideal payment by changing loan amount, interest rate and term and seeing the effect on payment amount. Use this loan calculator to determine your monthly payment, interest rate, number of months or principal amount on a loan.

0 kommentar(er)

0 kommentar(er)